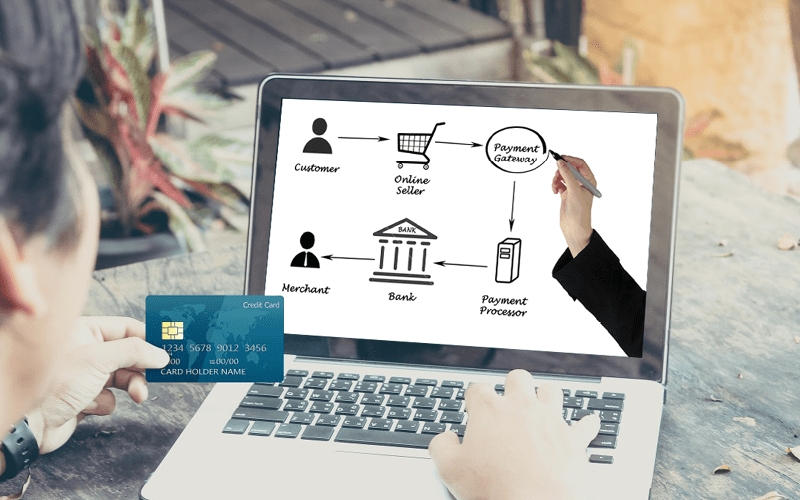

A Payment Gateway needs to be cutting-edge and precise for payment processing. Moreover, a payment processing channel should comply with your business as well. Thus, the crucial part of choosing the payment gateway providers and processors hits the dilemma.

We address this exact issue and bring you a compilation of the Top Best Payment Gateway Providers and Processors. It will help you make a faster choice and know about the service provider’s pros and cons. Your online business needs a definitive boost for processing online payments on your website. Thus, these service providers can be a huge help to you.

PayPal

PayPal is one of the leading names in the payment service providers. The founding individuals of the company are quite famous today. Moreover, they provide one of the best payment processing solutions around the globe.

PayPal is a payment aggregator, and that is what makes the company unique. A payment aggregator allows you to process payments through their service without any merchant account. You can start with the services and accept payments online seamlessly. However, PayPal has a strict policy against high-risk merchants. If your chargeback ratio crosses a certain mark, they will immediately hold the money, and you will have to go through a long process for it. Moreover, PayPal uses automated services; therefore, they have bad merchant support or assistance demerit. You may have a query or a problem, and you won’t reach them for support.

Stripe

Stripe is a Payment Gateway Provider as well as a Full-Stack Payment Processor. Unlike many service providers, they have a dedicated plugin for Payment Processing. In the eCommerce industry, Stripe is one of the most-known service providers. WooCommerce by Stripe is a WordPress plugin that can allow an eCommerce business to readily accept online payments.

Moreover, they have various supporting functionalities for your business mind as well. Stripe provides a complete ecosystem for payments across the globe. However, Stripe has some disadvantages for your business. Some of the users report that their UI is not the most intuitive one. They don’t deal in high-risk businesses and limits their solutions to eCommerce businesses only.

Amald – Payment Gateway Providers

Amald is known for the expert services for your High-Risk Business. Extremely dedicated merchant assistance with support and a tone of features of a Payment Gateway makes Amald unique. Moreover, Amald has Anti-Fraud Tools with Chargeback Protection for your business. Therefore, you get advanced state-of-the-art services for your business.

A plus to the complete scenario is Amald has excellent Integration capabilities. API, SDK, Plugins for a hosted, non-hosted, self-hosted payment gateway with plugins for your WordPress becomes easy for you to onboard the services. Amald also serves as a payment processor to readily process the payments without tying up with Card Issuing Payment Processor.

Amald’s payment gateway has all the necessary features that offer great benefits to high-risk merchants.

Authorize.net

The company is well regarded in the industry of payment gateway providers. Your business needs to tie up with a payment processor such as Card Issuing Companies to process the payments. However, authorize.net has quite some features and integration capabilities. Most of the merchants praise them for the services they provide to the merchants.

Their integration capabilities are not the best in the industry. Though they are using API, they underperform the integration of the payment gateway. Even their recurring services is not upto the mark. Most of the merchants complain about the UI and dashboard setbacks as well. They deal in low and medium-risk businesses only.

Square

Square was found in 2009 by Jack Dorsey and Jim McKelvey. Their Payment solutions offer you some of the best services around the world. In other words, Square has something great for a brick-and-mortar shop. They have dedicated POS services for a business as well. It makes Square stand out from the crowd.

However, as the company has fewer years of experience, there are chances of errors. Most of the merchants report they have weak merchant support and costly add-on services. Moreover, they do not accept high-risk businesses. Therefore, if your business has a high chargeback ratio or volatility in the market, then you have lower chances to get the services from Square.

Conclusion

To sum up. These are some of the best gateway providers and processors in the world. Be sure to research the net about your business first. In other words, a high-risk business has to crucially choose between all these service providers.

PayPal, Stripe, Square, or Authorize.net doesn’t deal in the High-Risk industry. Thus, if you choose them, you have a high chance your transactions will be on hold. This will hamper your brand image and cause problems for you in the long run. However, with Amald, your business will have dedicated merchant assistance and support and get expert solutions for high-risk payment processing.

Visit Another Page : Offshore Merchant Account, High Risk Merchant Account, International Payment Gateway